Is Your Business Failing or Thriving?

Discover Jon's 4-Part System For Improving Your Cash Flow And Businesses' Overall Performance Without Working Any Harder Than You Do Now

Facts:

70% of businesses fail within 10 years.

SMB Owners are worried about their cash flow and feel overwhelmed with their financial performance.

Owners don't know how their business is performing or how to make it better.

Owners don't know the value of their company or how to continually improve it.

All businesses need a CFO - either a full-time employee or one on a fractional basis - OR the owner needs to dedicate time to being their own CFO.

Download the Free 29-Page Guide Now

Download my free 29-page guide to improving your small or medium-sized business. A process developed from over 30 years of business experience, I've discovered what works and what doesn't. I can help you overcome failure, build a resilient company, and unlock success.

Verbeck Associates can help. We provide fractional CFO Services to businesses from Startup to $50,000,000 with 1-50 employees on a monthly retainer basis.

Jon has tremendous experience beginning his career at KPMG and a CFO of a growing 9 figure computer company. Now running a Fraction CFO firm for the last 19 years, the team has served hundreds of companies. over the years being their Fractional CFO or business turnaround specialist. Jon received an award from the TMA for Turnaround of the Year.

Jon has owned small businesses - some growing some struggling. He learned and hone core principles around Forecasting, Financial Reporting, and Monitoring Cash Flow that are guaranteed to help most small businesses. This won't apply to all businesses, but it does to many..

I wrote a 29- page guide to help you be a better CFO. It's full of tips and hacks for business owners to be better equipped to handle running a business. Jon's main focus is providing fractional CFO Services. If your interested in hearing more, schedule a brainstorming session here and we can chat more.

One

Jon has been in the financial industry for over 30 years, and in business for himself for over 19 years. He's gained tremendous experience in that time and Verbeck Associates continues to grow using technology and a small and mighty team.

Two

Jon has developed a 4-part system to focus on solid numbers, a cashflow forecast process, a weekly scorecard, and monthly CFO reports.

Three

Customers love the results:

Better profitability

Structured Processes

Predictable Cash Flow

A structured closing process

A rolling monthly financial forecast

Weekly Dashboard

Monthly CFO Reports

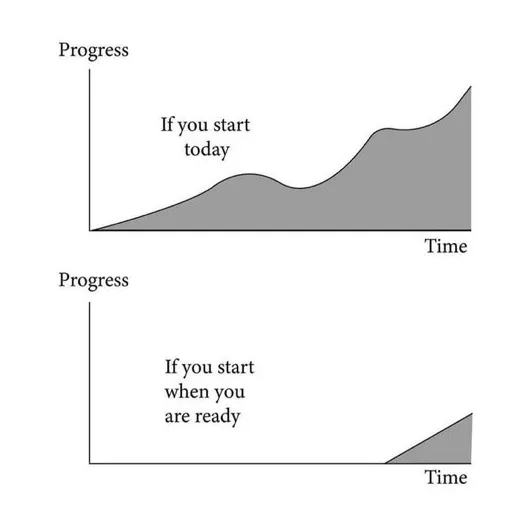

Most business owners wing it. Don't be one of them. Have a Plan!

Client Results

Aerospace Manufacturer - 100 employees

Mounting losses and rising debt.

Restructured capital and reforecast/restructure to very profitable.

Large Vehicle Distributors with 3 parts and service locations ~ $60mm

Provided strategic assistance. Company sold at a solid multiple.

Computer Services Company - 2 locations, $15mm in revenue.

Provide Fractional CFO Services on an ongoing basis. Value: solid reporting, with forecast and accountability with team continual process improvements to scale. Monthly CFO Reports; Owner sleeps better.

Early Stage BioTech Company - SEC quarterly reporting

Financial Services Company - ongoing fCFO.

Environmental Services Company - tempCFO for 4 months to hire FT CFO. Company is rocking.

Bio Sheet

Prior to his business consulting career, Jon gained significant operational and leadership experience from 14 years as CFO of a rapidly growing PC manufacturer and distributor. He acquired his initial financial experience with both large and small companies as an audit manager with the worldwide accounting firm KPMG. Jon works with a broad range of clients to develop effective growth strategies and to drive successful project execution and implementation. These experiences include:

· Consulting CFO with public traded companies and other SMB private companies

· Start-ups and businesses in need of financial modeling and strategic assistance

· Specific profit improvement strategies, strategy execution projects, business modeling, business process improvements, cash flow forecasting management, and implementation and testing of internal control policies and procedures.

· Troubled companies and turnaround projects.

· Non-profit interim CFO and turnaround / efficiency projects.

· Medical practice optimization projects.

Jon regularly provides CFO and business advisory services and helps develop strategies with actionable plans that enhance profitability and cash flow.

Jon works with organizations from start-ups and businesses in need of financial modeling, to public company CFO Services, to college interim CFO to profit enhancement and strategic advisory for turnaround businesses. Jon’s clients have included a wide variety of manufacturing, service and distribution companies, non-profit organizations, higher education, and medical practices, ranging from $2 million to $1.4 billion in sales and revenue. Jon was awarded the Turnaround of the Year award by the Turnaround Management Association and was recognized in the Journal of Corporate Renewal. Jon is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants. He is an Ironman Triathlete and received his Bachelor of Science degree in accounting from Syracuse University’s Martin J. Whitman School of Management.